President Trump signed into law the largest economic stimulus package in modern American history. Unfortunately, it comes too little too late for the small businesses at the heart of our neighborhoods, who are in dire need of help if they are to survive the economic impact of COVID-19.

Our data reveals that more government action is needed beyond what is in the CARES Act. Main Street businesses need a new stimulus package to provide “restart capital” in order to stave off closure and reopen their doors when this public health crisis is resolved.

A view from ground level

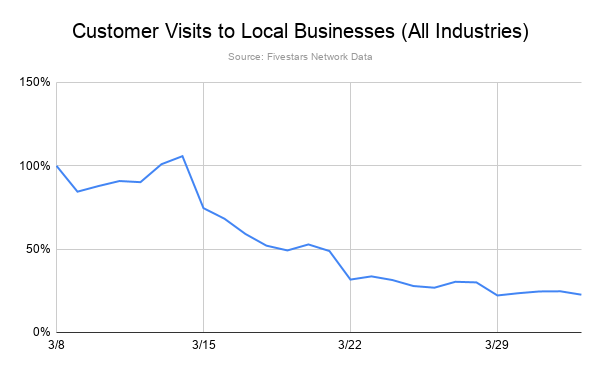

According to purchase behavior data collected by Fivestars based on millions of customer transactions, local businesses have experienced a 77% decline in sales as a result of the novel coronavirus.

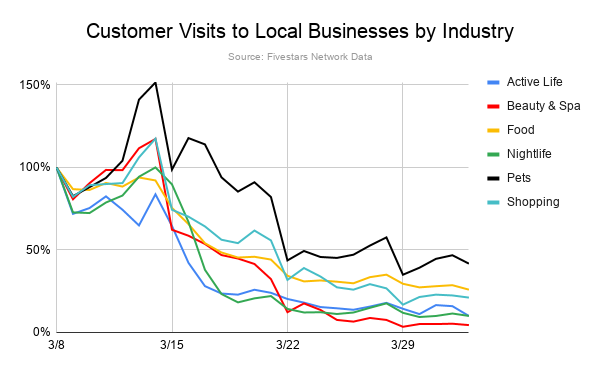

Though the downturn was initially concentrated in Seattle and San Francisco, in three short weeks similar effects have cascaded to every city nationwide. Sadly, some industries are suffering more than others, like beauty salons and spas which show a 96% drop since March 8.

Diving deeper, we see that specific types of businesses are particularly hard hit:

- Clothing stores down 97%

- Hair salons down 97%

- Nail salons down 99%

Grocery, tobacco, and pet stores appear slightly more resilient:

- Grocery stores down 46%

- Tobacco shops down 58%

- Pet stores down 57%

And, while coffee shops and restaurants are 75% down, still eking out some sales with delivery and takeout, it won’t be enough to survive long term “shelter in place” orders.

A state of emergency for America’s Main Street

The typical businesses on Fivestars are brick-and-mortar, independent shops servicing a neighborhood clientele with a staff of 20 or fewer. Based on payment processing data from our platform, they average around $550,000 in annual revenue but have slim profit margins. These local businesses are often under-insured and thinly capitalized and have a very little buffer to withstand a crisis.

Most of them cannot last more than a few weeks before they have to shut down or lay off employees. A recent Fivestars survey1 revealed that nearly 3 out of 4 business owners can last less than 4 weeks under temporary shutdown—with 1 in 4 reporting that they can last just a single week. Businesses with less than one month of runway include 75% of restaurants, 74% of clothing stores, 86% of coffee & tea shops, and 88% of nail salons who responded to the survey.

Every passing day is pushing more businesses to the brink. Here are a few quotes from business owners, illustrating the poignant emergency of the situation:

I’m scared to death that I will have to declare bankruptcy. Every day is a new challenge. Cash is low and those payments are still there. No one knows how tough it is on the little guy. (…) I’m fighting for every dollar. I won’t be able to hang in there forever. It’s a desperate feeling.

We’ve been in business over 30 years and most of our staff have been with us almost that long. Our entire lives have been put on hold and the fear of losing our livelihood is immense.

It’s been the most terrifying experience I’ve ever had. I’m fearful for my employees, the industry, my family, myself, my neighbors and the economy…

An act that could care more

The CARES Act provides $2 trillion in funding, with $370 billion earmarked for small businesses’ short-term relief. This is a small share of the pie for small businesses, which represent 99.9% of businesses in the US and employ 47.5% of the workforce2. And tragically the program’s design will not truly help the smallest, most-vulnerable local businesses that form America’s Main Street.

The flagship program for small businesses in the CARES Act is called the Payment Protection Program (PPP). The PPP specifies that businesses can take a loan for up to 2.5 times the average amount of their monthly payroll. Small businesses vary quite dramatically on what percentage of revenue is payroll, but for the typical Fivestars business (let’s call it Joe’s Sandwich Shop), it’s around 30%. This means that Joe can borrow about $34,000. However, payroll is just one fixed expense: his other big one is rent, which is about 10% of sales. The outstanding obligations for Joe’s Sandwich Shop over 2.5 months is closer to $45,000 (not counting the cost of unused and wasted inventory). As one small business owner said in response to the Fivestars petition for small businesses on the CARES Act:

Our government has underestimated the high dependency small businesses have on daily/weekly sales activity to meet payroll, rent, internet, electricity, insurance, and countless other financial commitments.

The Payment Protection Program is also forgiving loans based on the percentage of employees retained. Unfortunately, our recent survey showed that 43% of small business owners have already been forced to lay off some of their staff, and an additional 22% were expecting to shortly follow suit1. With lay-offs already a reality, the loan forgiveness will only apply to the most stable, well-funded businesses.

However, for many others, the loan will add to their debt burden and accrue interest payments. Our estimates show that these loan payments will shrink the profit margin of local businesses by at least 40% for the next 2 years. As one local merchant put it:

Taking out ANOTHER loan to save my small business is not an option for me as a small business owner. I do not need another payment, I need my doors reopened and people walking through my door and sales!

Finally, the PPP provides only $349 billion in loans for small businesses. It’s simply not enough to achieve its primary stated purpose, which is to cover the payroll expenses for the 30.8 million businesses that employ under 500 employees in America. According to census data3, these businesses account for over $14 trillion in annual sales and their estimated payroll expenses over 2.5 months are closer to $700 billion—double the funds dedicated to PPP. The Small Business Administration (SBA) who is managing the PPP program has already said they expect the funds to run out due to excessive demand.

While the CARES Act has also set aside $500 billion for the Treasury Department’s Exchange Stabilization Fund to provide liquidity to “severely distressed” sectors of the economy, it’s unclear how much of this might go to small businesses specifically, and what the exact terms of those loans will be. But what’s clear is that local businesses don’t need more loans: we believe that the government stimulus needs to be in the form of direct grants and rent or mortgage deferral to be truly helpful to small businesses.

A new stimulus package for Main Street

The CARES Act has a small $10 billion allotment for small businesses’ Economic Injury Disaster Loans (EIDL), which provide up to $10,000 of direct grants within 3 business days of application. This is the kind of fast relief small businesses need right now, but obviously, because of the small size of this fund, it will be drained quickly.

As a comparison, the government is setting aside for airlines $25 billion in payroll grants and $25 billion in loans to cover other expenses. In the short-term, until the loans are paid back, the government is taking an equity stake in the airlines. Our government must take a similar approach with small businesses, recognizing that we all already have “equity” in the future of our communities.

We are asking our government to take further action on behalf of small businesses—specifically, the 5.3 million independent businesses with 1 to 20 employees3 which are the lifeblood of our local economies. First, they need an immediate, interest-free suspension of all commercial rents, mortgages, and commercial loans. With this massive drop in sales, even businesses that are still able to operate are at high risk of folding under the pressure of fixed expenses and cannot afford to take on additional debt.

In addition, we’re calling for a new stimulus package for America’s Main Street, one which provides funds to help these neighborhood businesses start their operations again once the public health emergency passes. After months of slow to no sales, businesses will need new capital to buy fresh inventory, hire and train employees again, advertise their reopening, and pay their back rent—but precious few will have any money left to pay for this on their own. We estimate these costs will total $300 billion, or $55,000 per business on average. Our government must subsidize this “restart capital” to local businesses if we hope to see their doors reopen after the trauma of the coronavirus pandemic. We believe that setting this up as a 100% interest-free loan which is forgiven based on actual expenses is a close alternative to a direct grant while providing reasonable control.

The future of our local communities

Our small business landscape risks being forever changed by this pandemic. 28% of the businesses we surveyed are saying they have already shut down or are considering shutting down permanently. Typically less than 1% of small businesses shut down on any given month, meaning this is an astronomical increase. Among businesses that are currently closed due to government orders, a full 40% believe they are at risk of never reopening their doors.

We don’t have to resign to a catastrophic death spiral for our local businesses. We know they have resilience of spirit. If we act quickly and decisively to provide immediate support to local businesses and extend special grants when they are ready to restart, we may still preserve America’s Main Street for the future. If we don’t, we risk inviting a world increasingly dominated by Amazon delivery and permanent “social distancing.”

Sources:

1- Fivestars customer survey, March 20-23, 2020. Sample size: 431 small business owners of brick & mortar stores

2- Small Business Administration (SBA) 2018 Fact Sheet

3- US Census. Data for employer businesses (1-499 employees) based on 2017 County Business Patterns. Data for non-employer businesses based on the 2016 Economic Annual Survey.